XRP Price Prediction: Will XRP Hit $3 Amid ETF Momentum and Technical Resistance?

#XRP

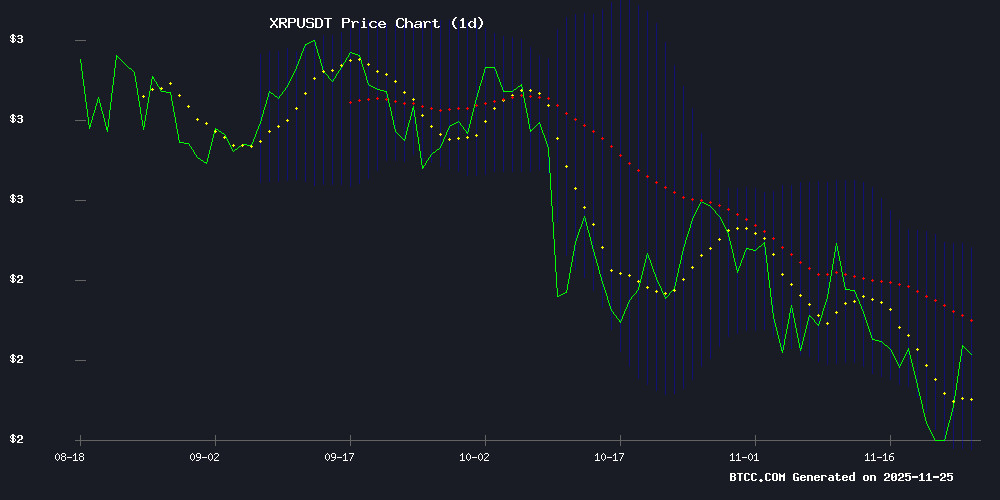

- XRP trading at $2.17 with key resistance at $2.51 Bollinger Band upper level

- ETF developments creating mixed sentiment with $164M inflows but failed GXRP launch

- MACD bullish but momentum slowing, requiring break above $2.22 MA for sustained upward movement

XRP Price Prediction

XRP Technical Analysis Shows Consolidation Pattern

XRP is currently trading at $2.17, slightly below its 20-day moving average of $2.22, indicating near-term consolidation. The MACD reading of 0.1476 above the signal line at 0.1120 suggests bullish momentum remains intact, though the narrowing gap of 0.0356 points to potential slowing momentum. According to BTCC financial analyst Michael, 'The current technical setup shows XRP trading within the Bollinger Band range of $1.92 to $2.51, with the middle band at $2.22 acting as immediate resistance. A sustained break above this level could trigger the next leg higher.'

ETF Developments Drive Mixed XRP Sentiment

Recent ETF developments have created conflicting signals for XRP. Franklin Templeton's successful launch of an XRP-backed ETF on NYSE Arca and $164 million in inflows have generated positive momentum, contributing to the 5.7% price rebound. However, the failed GXRP ETF launch and subsequent drop to $2.08 highlight ongoing market sensitivity. BTCC financial analyst Michael notes, 'While ETF approvals are fundamentally bullish, the market's reaction to the GXRP disappointment shows that resistance levels remain significant. The $2.50 level represents key resistance that must be overcome for sustained upward movement.'

Factors Influencing XRP's Price

XRP Price Prediction: ETF Launches Fuel Market Optimism Amid Key Resistance Watch

XRP's market trajectory shows renewed institutional interest as Grayscale's XRP Trust ETF (GXRP) and Bitwise's ETP gain traction, with Franklin Templeton poised to enter the space. The token hovers at $2.05–$2.10, testing a critical support zone that could precede a move toward $3 if bullish momentum holds.

"ETF listings don't guarantee rallies, but they're liquidity gateways," says CryptoFund Research's John Smith, underscoring the nuanced impact of regulated products. Technical patterns suggest upside potential, though regulatory shadows linger over price action.

XRP ETFs Attract $164M Inflows as Price Rebounds 5.7%

XRP's price recovery coincides with surging institutional interest, as spot ETFs recorded $164 million in net inflows on November 24. Grayscale's GXRP ETF led with $67.36 million, followed closely by Franklin Templeton's XRPZ ETF at $62.59 million.

The seventh consecutive day of positive flows pushed Canary's XRPC fund to $306 million in assets, now ranking 231st globally. Market analysts note this demand could absorb Ripple's available supply within six months at current rates.

The altcoin rose 5.7% following the ETF momentum, demonstrating how regulated investment vehicles are reshaping crypto market dynamics. 'When whales move, tides turn' - a nod to the growing influence of institutional capital in digital assets.

Franklin Templeton Launches XRP-Backed ETF on NYSE Arca

Franklin Templeton has entered the cryptocurrency arena with the launch of an XRP-backed ETF, trading under the ticker XRPZ on NYSE Arca. The move signals growing institutional confidence in altcoins following Ripple's legal battles with the SEC.

First-day trading volume surpassed 768,000 shares, demonstrating strong market appetite. This regulated product could serve as a blueprint for other alternative crypto ETFs seeking mainstream adoption.

The listing represents a strategic pivot for XRP, transitioning from regulatory uncertainty to institutional acceptance. Market observers note this development may accelerate the integration of digital assets into traditional finance frameworks.

XRP Drops to $2.08 as GXRP ETF Launch Fails to Lift Price

XRP struggles to gain momentum despite the introduction of Grayscale's GXRP ETF on NYSE Arca. The cryptocurrency hovers near $2.08 support, with resistance looming at $2.14–$2.15. Market structure remains bearish, as feeble bounces lack substantial buying volume.

Grayscale's expansion into altcoin ETFs—including XRP and Dogecoin—signals growing institutional interest beyond Bitcoin and Ethereum. Yet, early trading shows muted spot market reaction, with traditional ETF inflows failing to spur demand for the underlying asset.

Will XRP Price Hit 3?

Based on current technical indicators and market developments, XRP faces both opportunities and challenges in reaching $3. The current price of $2.17 requires approximately 38% appreciation to achieve the $3 target. Technical analysis shows the upper Bollinger Band at $2.51 presents immediate resistance, while the 20-day MA at $2.22 serves as near-term support.

| Level | Price | Significance |

|---|---|---|

| Current Price | $2.17 | Base level |

| 20-day MA | $2.22 | Immediate resistance |

| Upper Bollinger | $2.51 | Key resistance |

| Target | $3.00 | 38% appreciation needed |

BTCC financial analyst Michael states, 'While ETF inflows provide fundamental support, XRP must convincingly break through the $2.51 resistance level to build momentum toward $3. The mixed ETF news flow suggests this journey may encounter volatility, but the overall trajectory remains positive if current support levels hold.'